FIRE (Financial Independence and Retire Early)

The concept of Financial independence is leaving your job/career behind in preference for a life without the stresses and demands of the daily grind and give you freedom to do what you want, when you want.

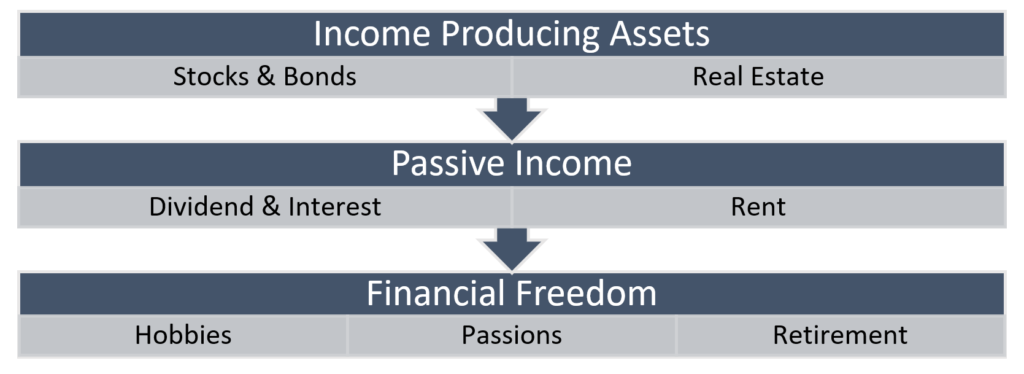

The pathway to financial independence is to accumulate enough assets that generate enough passive income to enable freedom and confidence to pursue our hobbies, passions or even achieve early retirement.

After working in the corporate environment for over 6 years, I figured that the traditional way of having a job/career is not for everyone and that there had to be another way. I have met a lot of interesting people at organisations who are trying to escape the traditional 9-5. They focused on side hustles and hoped one day their side business will replace their corporate salaries.

Not all jobs and careers are bad. I’m sure most people even like their jobs and the routine and friendships that their workplace makes available. The stresses, demands and inflexibility of traditional jobs and careers are what made me seek an alternative path; one that provide the freedom to work where I want, what projects I am interested in, and never feel shackled by any employer as I have the financial freedom to say “No, I don’t want to do that”.

Before venturing into how to reach financial independence it was important to understand what the reason is to embark on this journey. Ask yourself “What would I do with my life if I didn’t have to work for money?” is a good start. The things that come to mind are usually the things you like to do (hobbies and passions) but never really had the time or money to do!

The book Rich Dad Poor Dad explained that the “Rich Dad” used money to buy assets. Assets generate income resulting in the accumulation of wealth. In contrast, the “Poor Dad” and like everyone else, they use their income to pay monthly expenses and accumulate debt obligations like credit cards and various loans. There are all sorts of asset classes mentioned, however what stuck with me was index funds, and real estate.

Steps to Financial Independence

1. Increase Income

- Change jobs / careers progression – Although easier said than done, increasing your income and/or sources of your income is one of the levers to reach financial independence. Depending on your skills and experiences it may be very well worth switching companies get a higher salary each time.

- Start a side hustle – This can be using your existing skills to do something to earn income on the side.

- Passive income

2. Reduce spending

Increasing the gap between income and expenses means a higher savings rate. Saving 50% of your after sax income is

- Free things to do

- Free things on your birthday

- Zero waste

- Home-made items (Mouthwash, toothpaste, room spray)

- Cook at home

Sites to save money, when you have to spend money

- Top cash back / Quidco

- Money Saving Expert

- HotUKDeals

- Groupon

- Company discounts

3. Invest your savings

- Acorns / Moneybox / Betterment

- Low cost index funds

- Investment properties

No Comments